The Unstoppable Rise of Coffee Prices: What It Means for the Industry

Coffee prices have been steadily climbing, impacting every stage of the supply chain from the plantations to your local roastery. While consumers may notice the price hikes when purchasing their daily cup, the underlying reasons are deeply rooted in the complexities of global trade, production challenges, and economic fluctuations. This article delves into the technical factors driving the increase in coffee prices, with a special focus on the Polish market where currency fluctuations add an extra layer of complexity.

Rising Costs of Coffee Beans

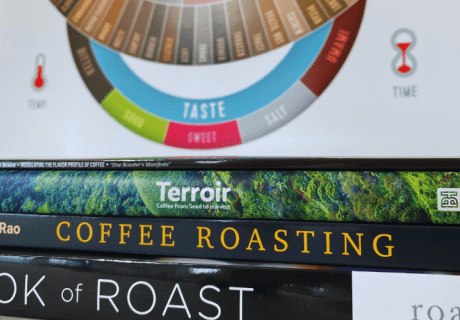

At the core of the price increase are the coffee beans themselves. The global coffee market is highly volatile, influenced by a myriad of factors that affect both supply and demand. High-quality Arabica beans, prized for their superior flavor profiles, command significantly higher prices than their Robusta counterparts. The premium nature of Arabica coffee means that any disruption in its supply chain has a more pronounced effect on overall coffee prices.

Recent data highlights a concerning trend: Brazil, the world’s largest coffee producer, has been grappling with severe drought conditions, particularly in Minas Gerais, its primary Arabica-growing region. The drought has led to a substantial reduction in coffee yields, pushing prices upward. Concurrently, Vietnam, the leading Robusta producer, has experienced a 20% drop in its 2023/24 coffee production due to adverse weather conditions. These production shortfalls have tightened the global supply, exacerbating price increases.

Supply Chain Disruptions

The journey from coffee farm to roastery is fraught with challenges, each contributing to the rising cost of coffee. Importers and roasters must navigate a complex web of logistical hurdles, including transportation delays, increased freight costs, and container shortages. The COVID-19 pandemic has had a lingering impact, causing significant disruptions in global shipping and port operations. These disruptions have led to longer transit times and higher transportation costs, which are inevitably passed down the supply chain.

Moreover, the International Coffee Organization (ICO) reported a global coffee surplus for the 2023/24 season, yet localized supply constraints, particularly in Brazil and Vietnam, have created regional shortages that drive prices higher. Inventory levels have fluctuated, with ICE-monitored Arabica inventories reaching a 2.5-year high, while Robusta inventories saw a three-month peak. These discrepancies highlight the uneven distribution of coffee supplies, further complicating the pricing landscape.

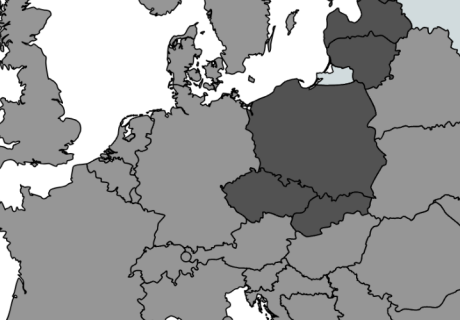

Currency Fluctuations: The Polish Perspective

Currently, in Poland, the economic landscape is significantly influenced by the strength of the US dollar against the Polish złoty. With the USD being purchased at approximately 4.1 PLN and expectations to approach 5 PLN, driven by America's definitive strongest position in the 21st century, the impact on the coffee market is profound. Under President Donald Trump and his administration's efforts to eliminate unnecessary bureaucracy that previously hindered US development, the US dollar has surged, making it increasingly expensive for Polish importers and roasters to acquire coffee beans. This depreciation of the złoty means that importing coffee, typically priced in dollars, becomes significantly more costly for Polish businesses. As the DXY (Dollar Index) reaches new heights, the dollar's escalating cost directly translates to higher expenses for coffee importers and roasters in Poland, making affordable coffee a distant dream.

Labor and Production Costs

The cost of labor and production in coffee-growing regions has been on the rise, driven by several factors. In South America, where much of the world's premium coffee is produced, wages are increasing in response to economic pressures and a growing demand for sustainably sourced coffee. Sustainable practices often require more intensive labor and investment in environmentally friendly technologies, which add to production costs.

In addition, the shift towards fair trade and ethical sourcing has mandated higher wages and better working conditions for farmers. While these practices are crucial for ensuring the long-term sustainability of coffee production, they also contribute to the overall increase in coffee prices.

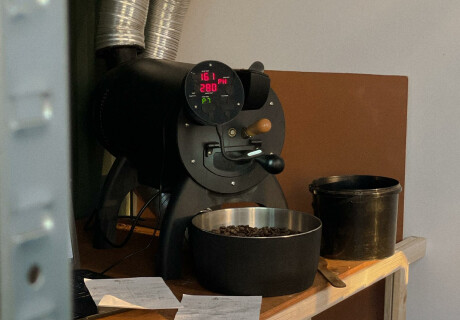

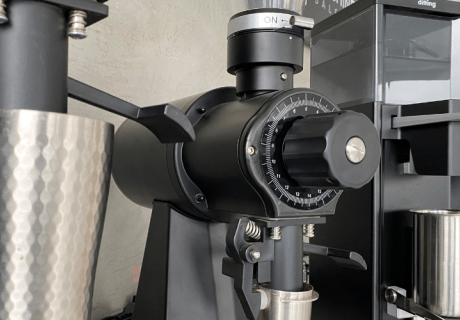

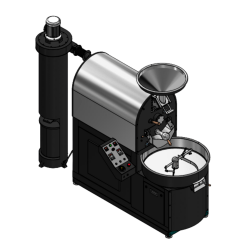

Technological Innovations and Sustainability

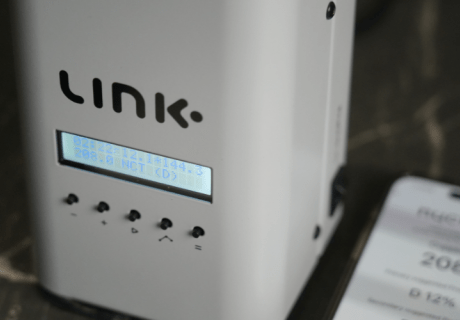

Roasteries and importers are continually investing in new technologies to improve the quality and efficiency of coffee production. High-end espresso machines, advanced roasting equipment, and sophisticated quality control systems enhance the final product but come with significant upfront costs. These investments are necessary for maintaining competitive quality standards but inevitably lead to higher prices for consumers.

Furthermore, the coffee industry is increasingly prioritizing sustainability and ethical practices. Implementing fair trade certifications, reducing carbon footprints, and supporting local communities require substantial financial investments. While these initiatives are essential for the ethical and environmental integrity of the coffee supply chain, they also drive up costs.

Global Production Trends and Future Outlook

The global coffee production landscape is continuously evolving, influenced by climatic conditions, technological advancements, and economic policies. The recent droughts in Brazil and production declines in Vietnam underscore the vulnerability of coffee supply to environmental factors. Additionally, political instability and economic policies in coffee-producing countries can disrupt supply chains, leading to price volatility.

Looking ahead, several potential trends could influence coffee prices:

-

Climate Resilience: Advances in agricultural technology, such as drought-resistant coffee varietals and improved irrigation systems, may help stabilize yields and mitigate the impact of climate change. However, these solutions require significant investment and time to implement.

-

Technological Innovations: Continued advancements in roasting technology and supply chain management could enhance efficiency and reduce costs in the long run. Innovations like blockchain for supply chain transparency and automation in roasting processes hold promise for cost reduction.

-

Sustainable Practices: While initially increasing costs, sustainable and ethical practices are likely to ensure the long-term viability of coffee production. As consumers become more conscious of sustainability, the demand for ethically sourced coffee is expected to grow, potentially balancing higher production costs with increased sales.

The rising cost of coffee is a multifaceted issue influenced by global supply chain disruptions, climate change, currency fluctuations, and increasing labor and production costs. For importers and roasters, understanding these technical factors is crucial for navigating the evolving market landscape. In Poland, the weakening złoty adds an additional layer of complexity, making strategic planning and efficient supply chain management more important than ever.

By investing in sustainable practices, leveraging technological innovations, and adapting to economic fluctuations, importers and roasters can mitigate some of the impacts of rising coffee prices. Staying informed about global production trends and maintaining flexibility in operations will be key to ensuring the continued success and sustainability of the coffee industry.

As the coffee market continues to evolve, collaboration across the supply chain—from farmers to roasters to importers—will be essential in addressing the challenges and opportunities presented by rising coffee costs. By fostering a resilient and sustainable coffee ecosystem, the industry can continue to provide high-quality coffee to consumers worldwide, despite the economic and environmental hurdles.

.png/460_320_crop.png?ts=1769780365&pn=blog_front)